When you’re broke and you start budgeting, it feels like trying to fill a bucket with holes. There’s hardly anything to manage, so what’s the point — right?

Wrong.

When you’re financially tight, that’s exactly when budgeting becomes not just important, it becomes powerful. Budgeting doesn’t require a six-figure income, but it requires a decision to take control and start now, no matter how small your resources are.

How to start budgeting when you are broke?

In this guide, you’ll learn how to start budgeting when you’re broke by using practical, low-stress steps you can apply today. Even if you’re down to your last $5 or €5.

Why Budgeting Matters More When You’re Broke

If you think budgeting is only for people with extra money, think again.

When you’re broke, every dollar or euro counts. If you’re not tracking where it goes, you’re letting your money disappear quietly and without permission.

Here’s why budgeting helps even when you’re broke:

– Clarity over chaos: Budgeting gives you a clear view of your finances to make better decisions.

– Break the paycheck-to-paycheck cycle: It helps you prioritize what’s truly important.

– Regain a sense of control. You may not have much, but you own what you do have.

– Make room for progress: Even saving $1 or €1 builds the habit of control and progress.

“Budgeting isn’t about limitation — it’s about intention.”

Step 1: Track Every Dollar or Euro You Spend to Start Budgeting

You can’t budget without knowing where your money is going.

Use one of these tools to start tracking:

– Pen & paper – always effective

– Google Sheets – use free templates

– Apps: Spendee, Goodbudget, and Money Manager

Look for “money leaks” such as:

– $5/€5 daily coffee

– Unused subscriptions (Netflix, Apple Music, etc.)

– Frequent takeout orders

These small changes add up quickly.

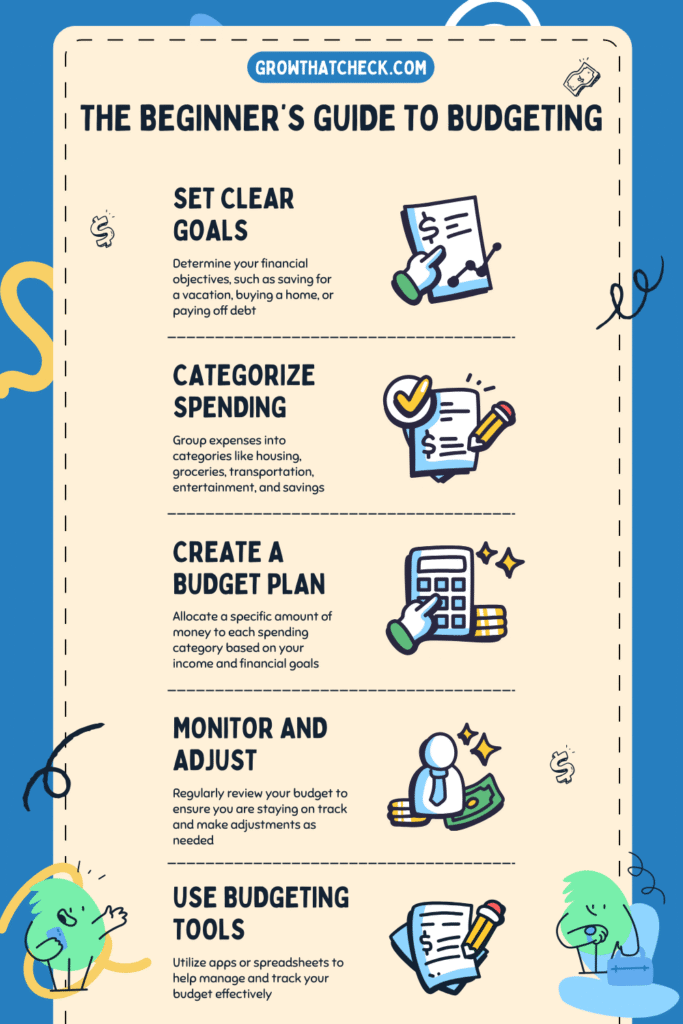

Step 2: Pick a Simple Budgeting Method

Three proven methods that work even when you’re broke:

1. Zero-Based Budgeting

Every dollar or euro is assigned a job. Nothing is left unaccounted.

2. 80/20 Survival Budget

Use 80% for essentials, 20% for savings or flexibility.

3. Cash Envelope Method

Withdraw cash for categories and place it into labeled envelopes. When it’s gone, it’s gone.

Use what works for you and adapt as needed.

Step 3: Cut Without Guilt — Not Comfort

Don’t deprive yourself and replace expensive habits with affordable or free alternatives.

Suggestions:

– Free YouTube workouts instead of a gym membership (search “FitnessBlender” or “Yoga with Adriene”)

– Pause subscriptions temporarily

– Brew coffee at home instead of cafés

– Use public transport or carpool

Cutting smart, not suffering.

Step 4: Prioritize the Essentials to start budgeting

Focus on what you truly need:

– Rent or mortgage

– Utilities (electricity, internet, water)

– Groceries (not snacks or junk)

– Transportation

– Medications

Eliminate or delay non-essentials like new clothes, tech gadgets, or subscriptions.

Step 5: Start an Emergency Fund

Build a habit of saving, even if it’s just $1 or €1.

Start a “safety net” account using:

– A savings account at your bank

– Digital wallets like [Revolut](https://www.revolut.com/) or [Monzo](https://monzo.com/) (EU/UK)

– A jar at home (label it “Emergency Fund”)

Tiny savings create big confidence.

Step 6: Find Extra Income

Even $10 or €10 a week makes a difference.

Ideas:

– Freelance (write, edit, design) on Fiverr or Upwork

– Sell unused items on eBay, Vinted, or Facebook Marketplace

– Take surveys on Swagbucks or ySense

– Offer local services: babysitting, tutoring, pet care

Start small and scale slowly.

Step 7: Review Weekly & Adjust

Set a weekly money check-in.

– Look at what you spent

– Track small wins

– Adjust the budget for the next week

– Focus on progress, not perfection

Budgeting is a practice, not a one-time fix.

Final Tips

– Start small: $1/€1 counts

– Don’t compare your journey with others

– Be flexible and forgiving

– Build habits that last

“You’re not behind. You’re just beginning. And beginnings are powerful.”

Free Download

Need a jumpstart? Use this free Google Sheets budgeting template to begin:

👉 [Download the Broke Budget Starter Kit]

Includes:

– Monthly budget tracker

– Weekly spending log

– Auto-calculated balance overview